Crypto Gains Ground in D.C. as CZ Pardon Gets Mixed Reactions

Early reviews say the industry’s big policy week was a success...mostly.

Welcome to the Friday edition of the Crypto In America newsletter!

What you’ll read: Crypto made its mark in the nation’s capital despite criticism over the optics of Trump’s pardon of Binance’s founder, and the week’s top headlines.

Tides turned for crypto in Washington this week.

A full day of meetings on Capitol Hill between pro-crypto Senators and industry leaders, kicked off by a drop-in from the White House’s crypto policy team, is said to have helped mend fences and inspire lawmakers back to the negotiating table to restart work on a bipartisan market structure draft.

Rumblings about a possible markup before Thanksgiving would give the group roughly a month to come together and get a draft ready. Meanwhile, the Senate Agriculture Committee has yet to release its own bipartisan proposal on the commodities side, led by Chair John Boozman (R-AR) and Sen. Cory Booker (D-NJ).

Get a full recap of Wednesday’s Capitol Hill crypto “blitz” here.

At the Fed, Governor Waller unveiled a policy that could let legally eligible crypto firms access the central bank’s payment rails directly, letting them operate more like traditional banks while limiting risk to the Fed’s balance sheet.

It’s significant for the industry because direct access to the Fed’s payment rails would let crypto firms settle transactions faster and rely less on partner banks, while also further legitimizing them by bringing them into the banking system.

It’s a bold move by Waller, who’s currently on the shortlist to replace Chair Jerome Powell as head of a regulator that’s been anything but welcoming to crypto firms seeking a master account in recent years.

In an interview with Crypto In America, Waller said he hopes guidelines for the ‘skinny master account’ could be in place within a year.

To cap it off, President Trump’s pardon of Changpeng Zhao, the Binance founder better known as ‘CZ,’ opens the door for the world’s largest crypto exchange to expand in the U.S. and for CZ to take a more active role in what he described as helping ‘make America the capital of crypto and advance web3 worldwide.’

The pardon, first reported as imminent by FOX Business’s Charlie Gasparino and confirmed this morning by the White House, sparked outrage from Trump critics like Senator Elizabeth Warren (D-MA), who accused the President of ‘pay-to-play’ tactics, citing a May Wall Street Journal report linking Binance, an Abu Dhabi sovereign wealth fund, and a Trump family crypto venture (World Liberty Financial) in a $2 billion deal.

“CZ pleaded guilty to a criminal money laundering charge and was sentenced to prison. But then he financed President Trump’s stablecoin and lobbied for a pardon. Today, he got it,” Warren said, angering many of the industry who argue Zhao did not plead guilty to money laundering but rather failing to maintain an effective anti-money laundering program.

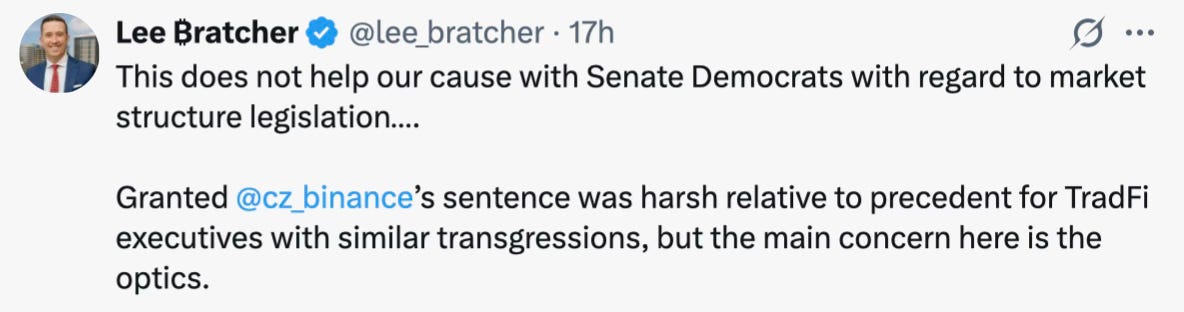

Even crypto supporters of Trump acknowledged that the optics of the pardon didn’t help the industry with Senate Democrats negotiating market structure reform, who remain wary of passing a bill that could be seen as legitimizing Trump profiting from crypto while in office.

And some Hill folks were on the same page.

“It makes it a lot harder for us to be able to do our jobs,” one Republican aide told Crypto In America.

It’s unclear whether CZ’s pardon will materially affect Senate market structure negotiations, but Warren, the most influential Democrat on the Senate Banking Committee, said the responsibility for action rests with lawmakers.

“If Congress does not stop this kind of corruption, it owns it,” she said in an X post.

Invest as you spend with the Gemini Credit Card®. Get approved to earn $200 in Bitcoin. Issued by WebBank. Terms apply.

Weekly Recap

ICYMI. Here are the biggest news stories this week from the intersection of Washington and Web3:

President Trump pardoned convicted Binance founder Changpeng Zhao.

The Fed proposed a limited-access, lower-risk master account that would give all legally eligible institutions direct access to the central bank’s payments rails.

The Consumer Financial Protection Bureau collected roughly 14,000 comments from fintechs and banks on how it should revise an open banking rule dictating how Americans control their personal financial information.

Custodia and Vantage Bank have launched a blockchain-based platform enabling traditional banks to issue tokenized deposits.

Crypto exchange Kraken reported 114% growth in Q3 revenue, up 50% from the prior quarter.

Prime brokerage FalconX acquired ETF provider 21Shares for an undisclosed sum, expanding its crypto ETF offerings.

Fidelity Digital Assets started supporting the trading and custody of Solana for institutional clients.

Stablecoins processed $46T in transactions over the past year, nearly three times Visa’s volume and closing in on the ACH network that powers U.S. banking, according to a new report from a16z crypto.

$1.8 trillion asset manager T. Rowe Price filed for its first actively managed crypto ETF.

Layer 1 blockchain Kadena announced it’s shutting down permanently, citing ‘unfavorable market conditions.’

NYC mayoral candidate Andrew Cuomo plans to create a Chief Innovation Officer for blockchain and AI, aiming to position the city as a global crypto hub if elected.

Remember, new editions of the Crypto In America newsletter drop every Monday, Wednesday and Friday at 7AM EST.

If you like what you’re reading, don’t forget to subscribe!