Treasury to Ease Corporate Crypto Tax Rule

CAMT is a 15% minimum tax on large corporations’ financial statement income

Welcome to the Wednesday edition of the Crypto In America newsletter!

What you’ll read: Treasury prepares to relax corporate crypto tax rule, industry urges new CFTC nominee as White House drops Quintenz, SEC opens crypto custody to state-chartered trust companies.

The Treasury Department is preparing to formally relax a proposed rule that would have forced companies like Michael Saylor’s Strategy to pay billions on unrealized bitcoin gains under a Biden-era tax law called the Corporate Alternative Minimum Tax (CAMT).

CAMT is a 15% minimum tax on large corporations’ financial statement income. Because Financial Accounting Standards Board (FASB) rules currently require companies to “mark-to-market” crypto on their books (meaning gains or losses are recorded at current market prices even if nothing is sold), paper profits on bitcoin would have been taxed while unrealized stock gains were exempt. This would have created a massive potential tax bill for firms like Strategy, which currently holds roughly $73 billion worth of Bitcoin.

The proposal drew pushback from Strategy and Coinbase, which in May sent a joint letter to Treasury urging the exclusion of unrealized crypto gains, saying it was unfair that digital assets should receive different tax treatment to traditional stocks and bonds. They warned that taxing paper profits could force companies to sell bitcoin just to pay taxes, put U.S. firms at a disadvantage versus foreign competitors, and even raise constitutional concerns over taxing income that doesn’t exist.

The issue has picked up steam in recent weeks as Congress and the Trump Administration has made moves toward tackling digital asset taxation.

The conversation continues later this morning with a hearing on crypto taxation in the Senate Finance Committee at 10:00 AM.

White House Pulls Plug on Quintenz’s CFTC Bid

The White House has pulled Brian Quintenz’s CFTC nomination, putting an end to a two-month waiting game that concluded Tuesday evening.

The former a16z crypto executive had been on track for confirmation by the Senate Agriculture Committee until the White House requested a hold on his vote before the August recess. In the weeks that followed, a series of leaked FOIA emails, a public spat with the Winklevoss twins, and concerns over Quintenz’s close ties to his former firm and his position on the board of prediction market Kalshi culminated in his nomination being withdrawn.

“Being nominated to chair the CFTC and going through the confirmation process was the honor of my life,” Quintenz told Crypto In America in a statement. “I am grateful to the President for that opportunity and to the Senate Agriculture Committee for its consideration.”

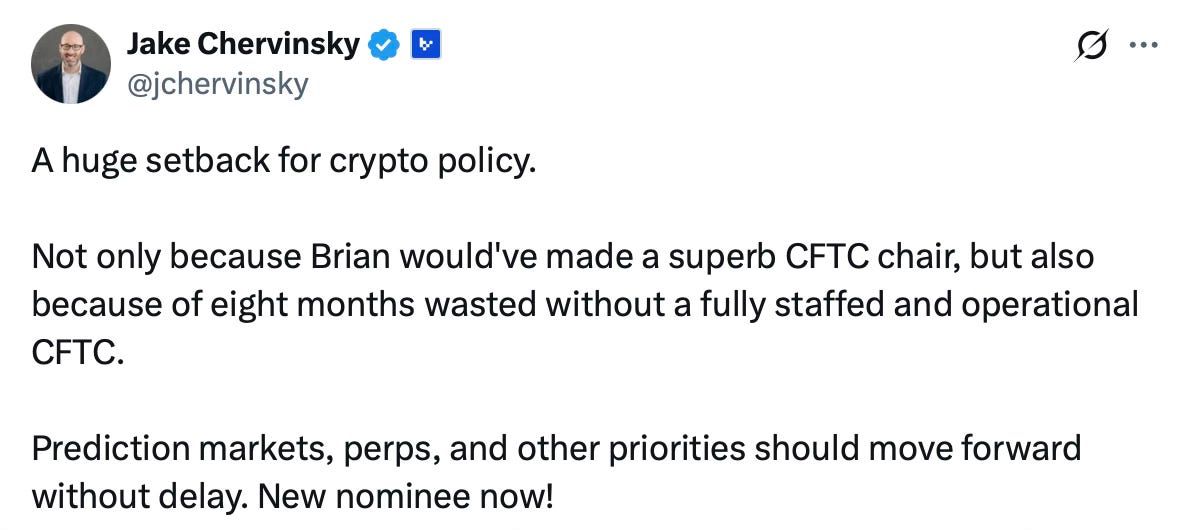

Since the news broke, industry players who supported Quintenz and had been excited about his potential leadership on crypto took to X to express their disappointment, calling the move a setback.

The White House is vetting outside candidates to fill the role and replace Acting CFTC Chair Caroline Pham. The current talent pool includes SEC Crypto Task Force Chief Counsel Mike Selig, Milbank LLP partner Josh Sterling, Treasury crypto adviser Tyler Williams, and former CFTC Commissioner Jill Sommers.

A source close to the to administration told Crypto In America an announcement on a replacement will be made soon.

SEC Greenlights State Trusts for Crypto Custody

The SEC has cleared the way for state-chartered trust companies to serve as qualified custodians for digital assets, opening the door for more entities to enter the crypto custody market.

On Tuesday, the regulator issued staff guidance in the form of a no-action letter, responding to a request from law firm Simpson Thacher & Bartlett that the SEC not take enforcement action against registered financial firms operating under the Investment Advisers Act of 1940 seeking to hold crypto on behalf of clients.

Under that statute, advisers must keep client assets with a qualified custodian, usually a bank or a trust company with national fiduciary powers. This guidance gives investment advisers and registered funds comfort that they can use a state trust company to custody crypto assets without fear of enforcement action.

“This clarity was needed because state-chartered trust companies were not universally seen as eligible custodians for crypto assets,” Brian Daly, Director of the SEC’s Division of Investment Management, told Crypto In America.

The guidance opens the door for more players including Coinbase, Ripple, Gemini, BitGo, and WisdomTree Funds to enter the crypto custody market.

Daly noted that while this is a staff letter rather than a formal rule, it provides immediate clarity for today’s managers and products, though future rulemaking could formalize the guidance further.

Remember, new editions of the Crypto In America newsletter drop every Monday, Wednesday and Friday at 7AM EST.

If you like what you’re reading, don’t forget to subscribe!

*Why is Acting…

Who’s Acting CFTC Chair Caroline Pham not being considered for the job as permanent Chair?