Mike Selig Confirmed as CFTC Chair Amid Busy Final Week for Crypto Policy

As Congress heads home, key market structure negotiations are expected to continue

Welcome to the Friday edition of the Crypto In America newsletter!

What you’ll read: This week’s top crypto stories and policy updates from Washington.

CFTC Chair nominee Mike Selig has been confirmed by the Senate, paving the way for a new era at the commodities regulator.

In a Thursday evening vote of 53–43, the Senate confirmed Selig as part of a bloc of nearly 100 nominees, including FDIC Chair Travis Hill.

Selig’s confirmation follows the announcement that Acting Chair Caroline Pham will join crypto payments giant MoonPay in the new year as Chief Legal and Chief Administrative Officer, a move first reported by Crypto In America. From Pham, Selig, who comes from the SEC’s Crypto Task Force as Chief Counsel, inherits an agency that became decidedly pro-crypto under her leadership and is set to take on an expanded role in U.S. crypto oversight once market structure legislation clears Congress.

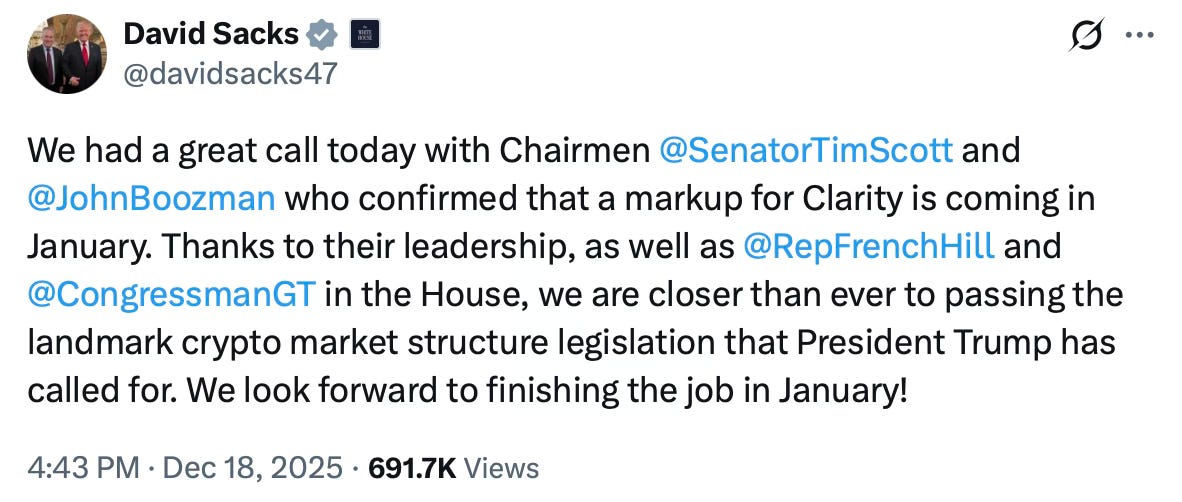

On the market structure front, Crypto and AI Czar David Sacks offered new insight into the timeline, saying he spoke with Senate Banking Committee Chair Tim Scott (R-SC) and Senate Agriculture Committee Chair John Boozman (R-AR), who confirmed a market structure hearing will be held in January.

It follows a Wednesday meeting held in lieu of a markup, bringing together crypto and banking industry leaders and Senate lawmakers to review draft bipartisan text being developed by the Senate Banking Committee.

Attendees who spoke with Crypto In America described the meeting as “productive” and “cordial,” despite the presence of groups with competing interests, with senators from both parties striking a “constructive and collaborative” tone as they took questions from participants. Notably, Democratic Sens. Mark Warner (D-VA) and Catherine Cortez Masto (D-NV) were described as engaged, asking what attendees characterized as “good questions” of both industry representatives and Banking Committee staff. Several attendees said they left the meeting feeling the process had reached a tipping point.

“The intensity of the negotiations makes me believe we’re really close to the target,” said Kara Calvert, Coinbase’s vice president of U.S. policy, who attended the meeting. “In my 25 years of watching legislation move through the Senate, it’s hard to remember something that wasn’t crisis-based that had this kind of momentum behind it.”

“I think we’re weeks away, not months,” she added.

Even as Congress heads home for the holiday break, negotiations are expected to continue over key sticking points in the coming weeks, including token classification, DeFi, and stablecoin rewards, the latter a major point of friction between crypto and banks.

On Thursday, the dispute played out in dueling letters to Congress: one, led by the Blockchain Association and signed by 125+ crypto groups, opposed efforts to “reinterpret and expand” the GENIUS Act’s prohibition on stablecoin interest; another, backed by 53 banking trade groups, urged lawmakers to “clarify and enforce” the ban on issuers and affiliated platforms offering yield, rewards, or interest, citing risks to economic activity.

In plain English: Banks warn that stablecoin rewards could trigger deposit outflows and curb lending, particularly at community banks. Crypto counters that banks are defending their incumbent revenue models and that rewards designed to incentivize customers do not compete with bank deposits.

It’s unclear how the Banking Committee will resolve this conflict between two of its biggest constituencies. Crypto industry players are encouraged that Senate Democrats, who have raised the most concerns on the topic, said in a recent proposal to Republicans that “Congress can find solutions to this issue that protect the banking system while still permitting rewards and incentives.”

Invest as you spend with the Gemini Credit Card®. Get approved to earn $200 in Bitcoin. Issued by WebBank. Terms apply.

Weekly Recap

ICYMI. Here are the biggest news stories this week from the intersection of Washington and Web3:

Mike Selig and Travis Hill were confirmed by the Senate as chairmen of the CFTC and FDIC, respectively.

Acting CFTC Chair Caroline Pham will join MoonPay in the new year as Chief Legal and Administrative Officer.

U.S. inflation fell to 2.7% as slower housing and food increases offset a surge in electricity costs.

The Federal Reserve withdrew 2023 guidance that effectively blocked uninsured banks from becoming Fed members and engaging in crypto.

Coinbase announced it will add prediction markets and stock trading to its platform in a bid to become a one-stop trading app.

NYSE owner ICE is said to be mulling a $5 billion investment in MoonPay, per a report from Bloomberg.

The SEC issued guidance on broker-dealer custody of crypto asset securities while reviewing the broader custody framework. It also released new FAQs on crypto and blockchain technology.

The CFTC is seeking public input to figure out the best way to oversee clearinghouses that allow retail traders to trade derivatives.

The FDIC’s Board of Governors voted to open a 60-day public comment period on its process for banks seeking to issue stablecoins through their subsidiaries.

Custodia Bank filed a petition for rehearing en banc, asking the full Tenth Circuit to reconsider its October decision that sided with the Fed in denying it a master account.

Stani Kulechov, founder of decentralized lending protocol Aave, announced that the SEC has concluded its four-year investigation into the entity with no charges recommended.

Fintech bank SoFi launched SoFi USD, a fully reserved, dollar-backed stablecoin, making it the first national bank to issue a stablecoin on a public blockchain. SoFi CEO Anthony Noto broke the news with Crypto In America first.

A delayed November jobs report showed that the U.S. unemployment rate rose to 4.6%, its highest since September 2021.

Nasdaq announced plans to extend trading to 23 hours a day, five days a week, seeking approval to meet growing international demand for overnight access to U.S. stocks.

PayPal announced that it filed applications with the Utah Department of Financial Institutions and the FDIC to create PayPal Bank.

JPMorgan launched its first tokenized money market fund, MONY, on Ethereum.

President Trump said he will consider a pardon for Keonne Rodriguez, the founder of the privacy-focused Bitcoin wallet Samourai.

Remember, new editions of the Crypto In America newsletter drop every Monday, Wednesday and Friday at 7AM EST.

If you like what you’re reading, don’t forget to subscribe!