Market Structure Markup Could Slide into January as Talks Drag On

Bipartisan negotiations continue as days remain until Congress leaves for holiday recess

Welcome to the Wednesday edition of the Crypto In America newsletter!

What you’ll read: State of market structure negotiations, Trump begins Fed chair interviews, CFTC and OCC take steps to bring crypto mainstream, and John D’Agostino joins the podcast.

The outcome of a Tuesday closed-door meeting between a bipartisan group of pro-crypto senators working on a market structure bill suggested that a pre-Christmas markup is becoming less likely and could slip until after the holiday recess, according to people familiar with the discussion.

The holdup is that Republicans and Democrats remain far apart on several key issues and are still deep in negotiations. The industry got a glimpse of that bargaining process Tuesday afternoon when a leaked copy of a three-page compromise offer that Senate Banking Republicans sent to Democrats was reported by Politico.

One of the proposed provisions involved giving Democrats assurance that front-end sanctions compliance for certain DeFi platforms would be included in the bill in exchange for preserving language that protects software developers and self-custody. Two major sticking points for Democrats — a requirement that Democrat commissioners serve on agencies overseeing crypto, and ethics language aimed at preventing top government officials from profiting off digital assets — were also included in the offer, though it’s not clear whether the restrictions target President Trump and his family directly.

Democratic negotiators have since sent back a counteroffer, which has not leaked. It’s unclear where those talks now stand or whether Senate Banking Republicans will be willing to accept it.

One thing is clear from listening to lawmakers this week: everyone involved seems worn out. At this week’s BA Policy Summit, Senator Bernie Moreno (R-OH) called negotiations “decently frustrating,” while Senator Cynthia Lummis (R-WY), head of Senate Banking’s Subcommittee on Digital Assets and a key architect of the market structure bill, said the staffs working on the bill are “exhausted.”

So what’s next? There’s now just seven working days before members leave for the Christmas break and negotiations are expected to continue. Lummis said she wants to release a draft text by the end of this week so the industry can vet it ahead of a potential markup next week. But that was before Tuesday’s member meeting, after which many walked away thinking that timeline might be ambitious.

Technically, Senate Banking Chair Tim Scott (R-SC) could still hold a markup next week and likely pass the bill along party lines. But securing bipartisan support in committee would make it far more likely the final bill passes the full Senate next year, which could be a reason to delay the markup until January or until negotiations have run their course.

Meanwhile, the Senate Agriculture Committee, which released its unfinished market structure draft last month, could still hold its own markup before members leave next week. But committee Chairman John Boozman (R-AR) told Bloomberg Tax on Tuesday that while he isn’t ruling out a markup, he would probably move it to next year, citing “difficult things to iron out.”

A committee spokeswoman told Crypto In America this afternoon that the committee will hold a markup ‘soon.’

Trump to Hold Final Fed Chair Interviews

President Trump is expected to begin interviewing his final picks to replace Federal Reserve Chair Jerome Powell as soon as today, with a decision expected in early January.

According to the Financial Times, Trump and Treasury Secretary Scott Bessent are set to meet with former Fed governor Kevin Warsh today, followed by National Economic Council director Kevin Hassett, who is reportedly Trump’s favorite to succeed Powell as head of the central bank.

Interviews are expected to continue into next week and may include other finalists for the role, including Fed Governors Christopher Waller, Michelle Bowman, and BlackRock’s Rick Rieder.

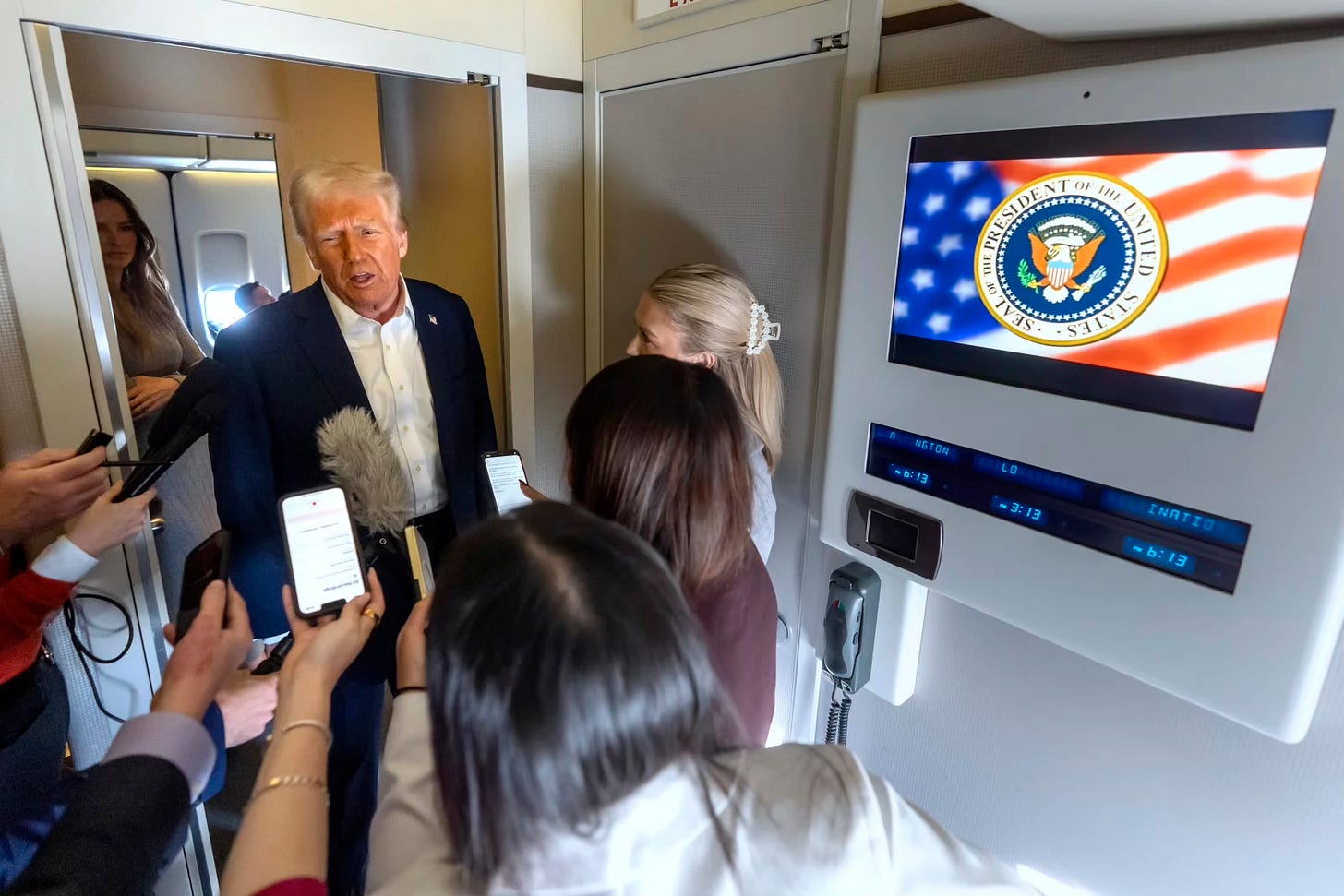

“We’re going to be looking at a couple of different people, but I have a pretty good idea of who I want,” Trump told the press pool Tuesday on Air Force One.

It comes as the Fed is widely expected to cut interest rates by a quarter point this afternoon, bringing the federal funds target range to a three-year low of 3.5–3.75%.

CFTC and OCC Take Steps to Bring Crypto Mainstream

Two big moves from the Commodity Futures Trading Commission and the Office of the Comptroller of the Currency this week are set to push crypto further into the mainstream.

The CFTC, under Acting Chair Caroline Pham, launched a pilot program allowing BTC, ETH, and USDC to be used as collateral in U.S. derivatives markets and exploring how tokenized assets, including Treasuries and money market funds, can serve as collateral. Participating firms must follow strict custody and reporting rules, including weekly disclosures for the first three months.

Why it matters: U.S. institutions can now use bitcoin, ether, and stablecoins as collateral for derivatives, freeing up capital and increasing efficiency. It’s a major step toward integrating crypto into regulated U.S. markets.

Meanwhile, the Office of the Comptroller of the Currency, which regulates national banks, clarified that they can engage in “riskless principal” crypto transactions, meaning they can buy crypto from one client and simultaneously sell it to another without holding the assets in inventory. This allows banks to act like brokers, taking on limited settlement and market risk while providing regulated access to crypto.

In its interpretive letter, the OCC drew a line between crypto assets that are securities and those that aren’t. Banks could already do riskless principal trades with securities since they don’t assume customer risk. Now, the OCC says the same rules apply to non‑security digital assets, treating them as just another part of the “business of banking.”

Why it matters: U.S. banks can now facilitate crypto transactions for clients, letting them trade through institutions they already trust and further integrating crypto into the traditional financial system.

“Put this alongside the CFTC’s new pilot program, and we have a clear direction of where regulators are heading: a cohesive global market,” said Jeremy Ng, founder and CEO of tokenization platform OpenEden.

Institutional Crypto Outlook with John D’Agostino

This week on the pod, we sat down with John D’Agostino, Head of Institutional at Coinbase.

We talked about how the U.S.’s largest exchange is positioning itself at the center of institutional crypto interest and why Wall Street is now more focused on liquidity than regulation. John also shared insights on market structure and the state of crypto in America, why the industry may not be out of the woods on de-banking, and why he’s watching the Czech National Bank’s Bitcoin experiment.

We also discussed how Coinbase is building a “super app,” expanding through acquisitions like Echo, and scaling its onchain infrastructure to support the next phase of institutional adoption.

Watch this episode on all platforms here.

Remember, new editions of the Crypto In America newsletter drop every Monday, Wednesday and Friday at 7AM EST.

If you like what you’re reading, don’t forget to subscribe!

From a blockchain security founder’s perspective, these market structure shifts aren’t just price movements, they’re stress tests. When liquidity thins and markup phases slip, we get a clearer view of which networks, protocols, and assets have real resilience versus those running on speculation alone.

Volatility exposes architecture.

Downturns expose assumptions.

And moments like this show why security, decentralization, and sound tokenomics aren’t “nice-to-haves”, they’re survival traits.

Markets may compress, but conviction built on fundamentals doesn’t.

This is where disciplined investors sharpen their thesis, not abandon it.

- 0xObsidianEnoch

Architecting the Future of Decentralized Trust.

Whoever wrote this article doesn't have a clue what's going on behind the scenes.. And I can tell you from someone who does know that it's not bad..!