Larry Fink Leads the Great 'Repotting' Era

Wall Street's crypto champion makes the case for embracing tokenization

Welcome to the Wednesday edition of the Crypto In America newsletter!

What you’ll read: Larry Fink is tokenization’s biggest advocate, ZeroHash and Public make a double podcast appearance, and this week’s top stories.

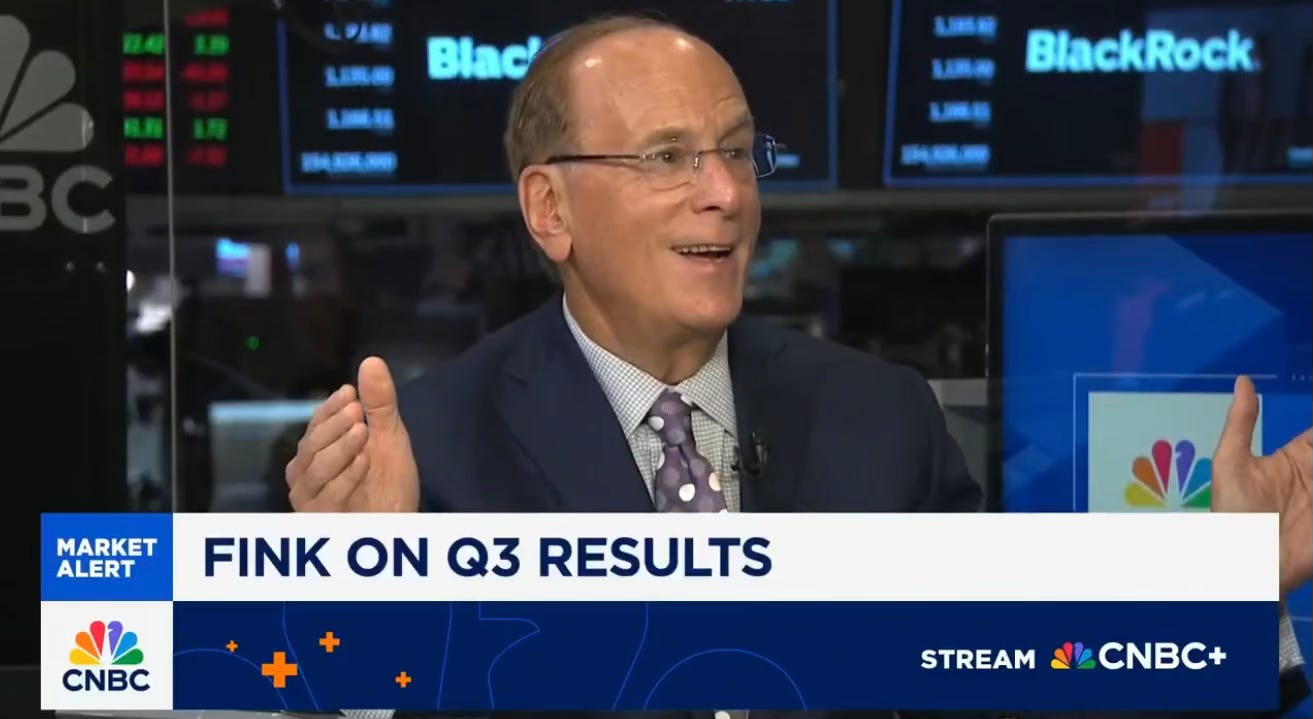

BlackRock CEO Larry Fink made headlines Tuesday on CNBC’s Squawk on the Street, touting a record third quarter that pushed the world’s largest asset manager to $13.5 trillion in assets under management.

Fink credited the milestone in part to BlackRock’s ETF platform, which topped $5 trillion for the first time, including $100 billion from its iShares Bitcoin ETF, the firm’s fastest-growing and most profitable fund.

But it was tokenization that really made Fink light up as he gushed about his firm’s plans to move traditional investment vehicles onto blockchain.

“We’re at the start of tokenizing all assets, from real estate to equities to bonds,” Fink said, noting it could draw new investors into traditional long-term retirement products via tokenized ETFs.

With fractional ownership, faster settlement, and 24/7 blockchain access, the move could open traditional investment vehicles to people who normally couldn’t afford them or younger investors who might otherwise overlook them.

“So we look at that as the next wave of opportunity for BlackRock over the next tens of years, as we start moving away from traditional financial assets by repotting them in a digital manner and having people stay in that digital ecosystem.”

A great visual representation for how the Wall Street behemoth is thinking about reshaping its business: taking traditional investment vehicles and putting them on chain, literally “repotting” them and letting them grow in the digital age.

And it’s not just the business that’s evolving.

“I grow and learn,” Fink said, responding to anchor David Faber’s reminder that he wasn’t always pro-crypto. In 2017, Fink famously called Bitcoin an “index of money laundering.” These days he calls it “digital gold.”

He also revealed that BlackRock is developing in-house technology to tokenize assets, saying the firm has spent a ‘great deal of time’ on it.

When Larry Fink talks, Wall Street tends to listen, as demonstrated by Fidelity, VanEck, Franklin Templeton, and WisdomTree following BlackRock’s lead on launching Bitcoin ETFs.

If this interview is any indicator, Fink is the gardener cultivating what will likely become TradFi’s great ‘repotting’ into the digital era.

Exclusive: Zerohash Parters with Public to Expand Crypto Trading

Edward Woodford of ZeroHash and Stephen Sikes of Public break down their new partnership to bring crypto trading to more Americans. They discuss why they made the deal, the focus on retail investors, and what customers can expect from the tie-up.

The conversation dives into the state of crypto in America, from last week’s record-breaking market drop to Morgan Stanley and others investors’ $100M bet on ZeroHash, giving it unicorn status at $1 billion. Edward shares his insights on the evolving regulatory landscape, the future of stablecoins and tokenized deposits, ZeroHash’s vision for institutional adoption, and why the debate over open banking matters.

Watch this episode on all platforms here.

Midweek Recap

It’s already been a busy news week. Here’s a quick catch up on the top headlines:

Roger Ver, also known as Bitcoin Jesus, has reached a settlement with the Department of Justice, agreeing to pay nearly $50 million in back taxes, penalties and interest to the IRS.

The DOJ seized a record $15 billion worth of Bitcoin from a massive pig butchering scam based in Cambodia, the largest seizure in government history.

Binance launched a $400 million “Together Initiative” to restore confidence in its platform after Friday’s flash crash, offering up to $300 million in USDC payouts to users and a $100 million loan fund for institutions.

Centralized exchanges have seen significant asset outflows since Friday’s crash, with Binance experiencing the largest at $21.75B in seven days, per data on CoinGlass.

Citigroup is aiming to launch custody services for crypto in 2026, according to CNBC.

Congressman Troy Downing (R-MT) has introduced a bill to codify President Trump’s executive order allowing crypto and alternative assets to be included in 401(k) retirement accounts.

California Governor Gavin Newsom signed a bill into law that would stop the state from liquidating unclaimed crypto without owner consent.

Tether has paid $300 million to settle Celsius’s bankruptcy claims, much less than the nearly $4.5 billion in Bitcoin the company originally sought.

Remember, new editions of the Crypto In America newsletter drop every Monday, Wednesday and Friday at 7AM EST.

If you like what you’re reading, don’t forget to subscribe!

That tokenization part is massive. You've really naiiled how important this shift is. Thanks!