GENIUS Gripes: State Preemption and Stablecoin Loopholes

Coalitions warn the GENIUS Act could weaken state oversight and threaten credit creation

Welcome to the Friday edition of the Crypto In America newsletter!

What you’ll read: Why the banking lobby is pushing lawmakers to revise the stablecoin bill, plus the week’s top headlines.

Banks, state regulators, and consumer advocates found plenty to complain about in the GENIUS Act this week.

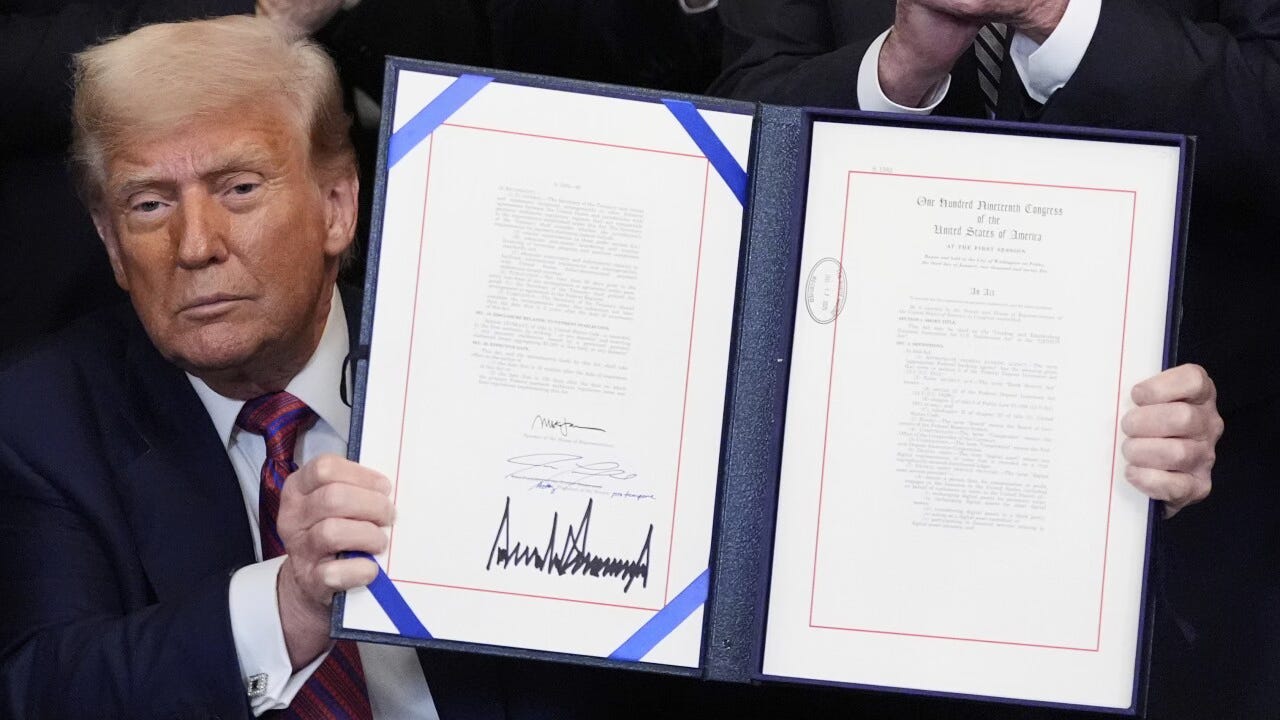

While last month’s signing of the landmark legislation was hailed by the crypto industry as a major milestone for mainstreaming digital assets, critics warn that certain provisions could undermine state oversight, put consumers at risk, and weaken the broader financial system.

Section 16(d) is at the heart of the concern. It allows certain uninsured, state-chartered banks to offer money transmission and custody services nationwide under OCC supervision, bypassing host state approval. In short, it lets the federal framework override state authority.

In a letter to Senate Banking Committee leaders, the Conference of State Bank Supervisors, the National Consumer Law Center, and other signatories warned that the provision undermines the dual banking system, restricts state oversight, and creates a loophole that lets certain banks operate like federally insured institutions without the same safeguards. They are calling on senators to strike the provision entirely.

Senator Cynthia Lummis (R-WY), a supporter of Wyoming’s Special Purpose Depository Institutions (state-chartered digital asset banks) and a recipient of the letter, said she supports changes to preserve a robust federal-state regulatory balance.

“We are currently witnessing an exodus of digital asset chartering activity from states to the OCC that must be resolved to maintain a viable dual-banking system,” she said in a statement. “I agree that section 16(d) requires changes, and I am happy to sit down with the Conference of State Bank Supervisors to craft language that protects consumers and promotes responsible innovation.”

Meanwhile, another coalition containing some of the same players are targeting what they see as a loophole on stablecoin interest payments.

The GENIUS Act currently prohibits stablecoin issuers from paying interest to holders, a restriction largely driven by the banking lobby’s argument that yield-bearing stablecoins could threaten their business. Now, banking groups including the Bank Policy Institute and American Bankers Association warn that the law does not go far enough, cautioning that exchanges, brokers and affiliates could skirt the rule, effectively turning stablecoins into a form of credit.

“The result will be greater deposit flight risk, especially in times of stress, that will undermine credit creation throughout the economy,” the group stated. “The corresponding reduction in credit supply means higher interest rates, fewer loans, and increased costs for Main Street businesses and households.”

The coalition backs its concerns with a Treasury Department report estimating that stablecoins could drive up to $6.6 trillion in bank deposit outflows if they are allowed to offer interest or yield.

Critics of the banking position, including Coinbase’s Chief Policy Officer Faryar Shirzad, argue that the $6 trillion stablecoin market figure is “pure fiction.” He says the number comes not from the Treasury but from the Treasury Borrowing Advisory Committee, which is made up of a number of banking industry players.

He also highlights research showing that stablecoin growth has not historically caused deposit outflows at community banks.

“If customers really would move $6 trillion away from banks into stablecoins, what does that say about the value consumers feel they’re getting from their banks?” he said.

Lobbying by interest groups is ramping up as lawmakers return to Capitol Hill in just over two weeks to tackle market structure legislation.

Invest as you spend with the Gemini Credit Card®. Get approved to earn $200 in Bitcoin. Issued by WebBank. Terms apply.

Weekly Recap

ICYMI. Here are the biggest news stories this week from the intersection of Washington and Web3:

Treasury Secretary Scott Bessent clarified that the department is exploring budget-neutral ways to acquire bitcoin, after prices fell following his TV remarks that the government would not be buying the asset.

A group of 80 crypto and fintech executives wrote a letter urging President Trump to stop banks from charging fees for access to customer data, arguing the practice stifles competition and limits consumer choice. Banks responded saying the letter seeks to “mislead” the Trump administration about open banking.

Wall Street giant Citigroup is exploring stablecoin custody, payments, and crypto ETF services.

Crypto exchange Bullish debuted on the NYSE Wednesday, doubling its IPO price of $37 and valuing the company at over $10 billion. Shares trading around $76 in Friday’s pre-market.

Bo Hines stepped down as Executive Director of the White House Crypto Council to return to the private sector. Read Crypto In America’s exclusive here.

Tornado Cash developer Roman Storm’s defense team plans to file post-trial motions by Sept. 30 that could challenge his guilty verdict for operating an unregistered money transmitter.

Former Ohio Senator Sherrod Brown is eyeing a comeback, planning to challenge junior Senator John Husted in the 2026 special election after losing his seat to Bernie Moreno in 2024.

Terraform Labs founder Do Kwon pleaded guilty in the conspiracy to defraud and wire fraud over the $40 billion TerraUSD and Luna collapse, facing up to 25 years in prison.

Andreessen Horowitz and the DeFi Education Fund proposed a DeFi app safe harbor to the SEC, aiming to clarify that building neutral blockchain interfaces doesn’t make software developers brokers.

Tron founder Justin Sun filed a lawsuit against Bloomberg seeking to prevent the disclosure of his crypto holdings which he says could expose him to "significant risk of theft, hacking, kidnapping, and bodily harm."

Remember, new editions of the Crypto In America newsletter drop every Monday, Wednesday and Friday at 7AM EST.

If you like what you’re reading, don’t forget to subscribe!

Maybe banks should just offer interest. 🥴