Crypto Voters Back in Play for 2026, New Poll Shows

Fresh polling shows younger, diverse crypto investors are leaning red

Welcome to the Wednesday edition of the Crypto In America newsletter!

What you’ll read: New polling shows crypto voters are returning as a bloc in the midterms, ETF issuers prep applications for approval, Wall Street dives deeper into crypto, and Solana co-founder Anatoly Yakovenko joins the podcast.

As crypto lobbyists and political operatives gear up for the 2026 midterms, early polling shows digital asset investors are once again shaping up to be a formidable voting bloc.

New polling from consulting firm McLaughlin & Associates, in partnership with the Digital Chamber, shows crypto investors carry real political weight heading into 2026. The firm surveyed 800 investors online between July 26–30 and found that 64% consider a candidate’s stance on crypto “very important.”

Interestingly, those surveyed could be the definition of swing voters — they identify as Democrats on paper but say they plan to back Republicans on the generic congressional ballot, with many saying candidates’ crypto stances will influence their vote for Congress.

Most also approve of Trump’s performance and trust him and the GOP more than Democrats to advance smart crypto policy in the U.S. They strongly support Republicans’ rollback of strict Biden-era rules and enforcement, with even Democratic and Independent voters showing bipartisan backing for big-ticket measures like market structure reforms and a strategic Bitcoin reserve.

Demographically, the group skews younger, diverse, and college-educated. They make their own investment decisions and tend to hold crypto for the long term. Regionally, investors are spread across the country: 34% in the South, 29% in the West, 19% in the East, and 17% in the Midwest. The group is 52% White, 19% Hispanic, 18% Black, and 9% Asian. Two-thirds are men, and most are under 45.

The bottom line: Crypto voters cut across parties but are leaning red. In a cycle where a few thousand votes could swing key congressional districts, they could be ones to watch.

Issuers Dot I’s, Cross T’s on Crypto ETF Applications

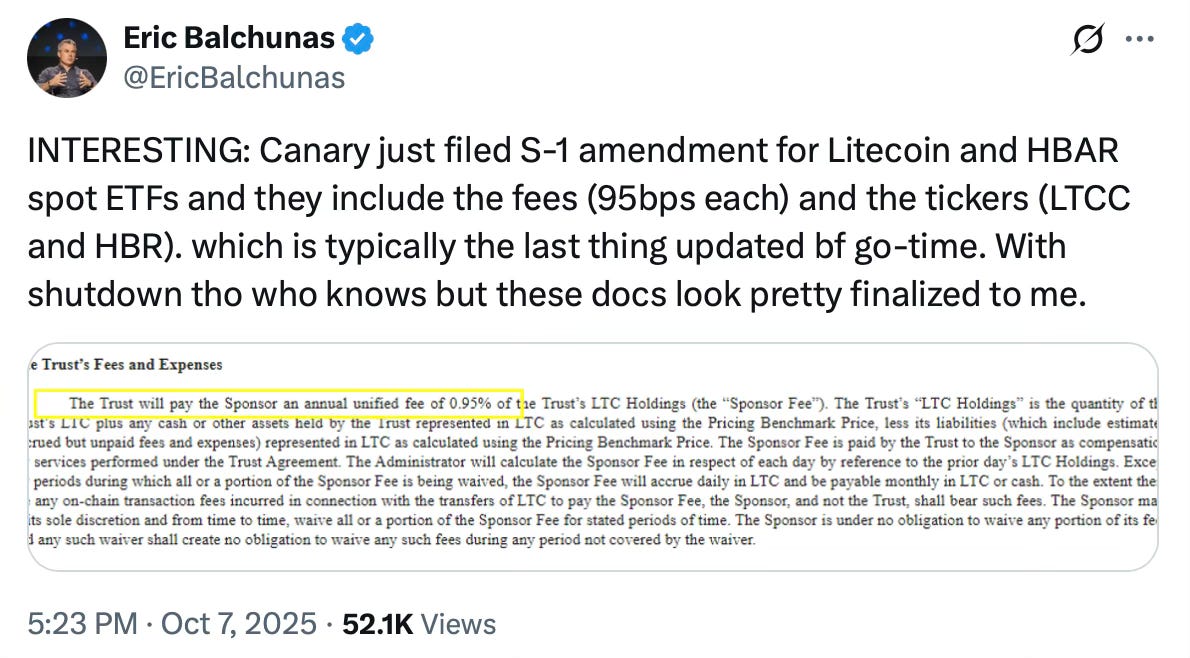

Bloomberg ETF analyst Eric Balchunas spotted that Canary Capital filed amendments with the SEC on Tuesday for its Litecoin and Hedera spot ETF applications, adding management fees and tickers for both.

He noted that those details often appear just before launch, fueling social media speculation that the SEC could approve the products imminently, even as most of its staff remains furloughed during the government shutdown.

However, as Crypto In America has reported, the SEC is operating with a skeleton crew and can only handle essential market functions. Routine work — including IPO and ETF approvals, rulemaking, corporate filing reviews, and most enforcement cases — is on hold until funding resumes.

“Issuers are likely trying to get 100% ready for when the SEC returns to normal so there are no delays and they can get to market as quickly as possible,” one source close to the process told Crypto In America.

Balchunas also noted Canary’s relatively high management fee of 0.95% for its Litecoin and Hedera ETFs, compared with spot Bitcoin ETFs, which range from as low as 0.21% for ARK 21Shares to 1.5% for Grayscale’s Bitcoin Trust. Grayscale, meanwhile, has proposed a 2.5% fee for its own Litecoin and Hedera ETFs.

“It’s pretty normal to see higher fees for areas that are new to being ETF-ed and increasingly niche,” Balchunas said, adding that cheaper products could appear if outflows occur.

Wall Street Makes Big Crypto Moves

As Washington has warmed to crypto this year, Wall Street has quickly followed suit and hardly a week goes by without a major financial institution announcing plans to explore tokenization, integrate a stablecoin, or partner with a crypto company.

But some weeks stand out more than others, and this is one of those weeks.

On Tuesday, ICE, the parent company of the New York Stock Exchange, announced a $2 billion strategic investment in blockchain-based prediction market Polymarket, valuing the company at around $8 billion. As part of the deal, ICE will distribute Polymarket’s market data globally and plans to collaborate with the company on tokenization in the future. The other two big TradFi exchanges, CME Group and Nasdaq, are exploring tokenization initiatives too.

S&P Dow Jones Indices, the firm behind the S&P 500, is launching the S&P Digital Markets 50, an index of 15 cryptocurrencies and 35 crypto-related stocks. The firm says crypto has grown mainstream enough to deserve its own index. “Cryptocurrencies and the broader digital asset industry have moved from the margins into a more established role in global markets,” said Cameron Drinkwater, Chief Product & Operations Officer at S&P Dow Jones Indices. “From North America to Europe to Asia, market participants are beginning to treat digital assets as part of their investment toolkit.”

The world’s largest asset custodian, BNY Mellon, has quietly been exploring tokenized deposits, or letting clients make payments via blockchain, according to Bloomberg. The bank, which manages over $55 trillion in assets and roughly $2.5 trillion in daily payments, is reportedly looking to modernize its payments infrastructure more broadly as it looks to move into real-time, instant and cross-border settlements.

Wealth management giant Morgan Stanley, long cautious about recommending crypto to clients, advised allocating a small portion of portfolios to digital assets, suggesting exposure of 2% to 4% depending on risk appetite. The firm also called Bitcoin a “scarce asset akin to digital gold,” echoing comments from BlackRock CEO Larry Fink. The investment bank is also planning to roll out crypto trading for E*Trade customers in early 2026 through a partnership with digital asset infrastructure provider ZeroHash.

Inside Solana Labs: Anatoly Talks Tech and Tokenization

This week on the podcast, we sat down with Anatoly Yakovenko, co-founder and CEO of Solana Labs, to talk all things Solana, on-chain capital markets, and the projects quietly moving the ecosystem forward. Anatoly shared why he thinks Wall Street financializing crypto isn’t a threat, how on-chain IPOs could reshape capital formation, and spotlighted hidden gems on Solana, including Helium’s decentralized wireless network and Hive Mapper’s global mapping initiative.

We also got a peek into Anatoly off-chain: he’s keeping a close eye on the Eagles, loves hockey and basketball, and had thoughts on Bad Bunny headlining the Super Bowl halftime show.

Watch this episode on all platforms here.

Remember, new editions of the Crypto In America newsletter drop every Monday, Wednesday and Friday at 7AM EST.

If you like what you’re reading, don’t forget to subscribe!