Crypto Leaders Descend on Capitol Hill for Market Structure Talks

Trump’s crypto czar and top industry execs meet Senate Democrats and Republicans to push market structure reform

Welcome to the Wednesday edition of the Crypto In America newsletter!

What you’ll read: Your guide to crypto’s Capitol Hill takeover, plus Fed Governor Waller on “skinny” master accounts, Bitcoin as “electronic gold,” and the Fed’s new payments era.

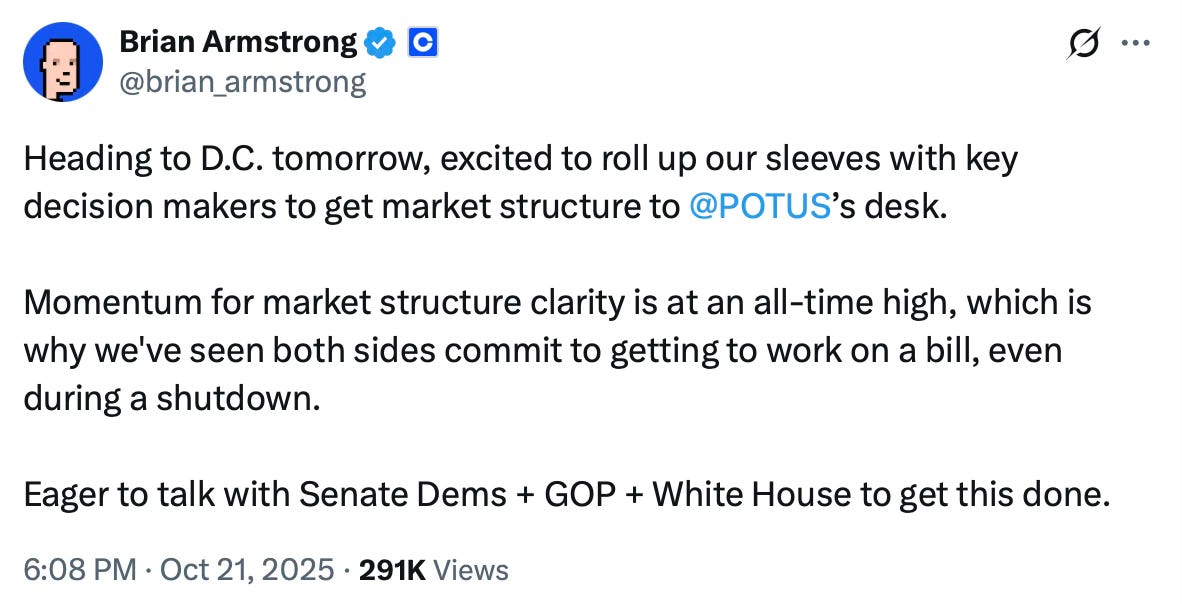

Executives from some of crypto’s biggest firms, along with President Trump’s Crypto and AI Czar, will descend on Capitol Hill this morning to meet with Senate Republicans and Democrats grappling with market structure legislation.

Their goal: reignite bipartisan talks and get a bill to President Trump’s desk before the midterms take priority.

Here’s how today’s crypto Hill blitz is shaping up and who will be in the rooms:

At 10:00 a.m., President Trump’s policy lead on crypto and artificial intelligence, David Sacks, will meet with Republican members of the Senate Banking Committee to reiterate the White House’s message: passing market structure legislation into law this year is a top Trump priority. The meeting, Crypto In America has learned, is geared toward senators like John Kennedy (R-LA), who has pushed back on his colleagues’ rush to advance their version of the House’s CLARITY Act, saying in a floor speech last week that the committee might need multiple hearings to understand what he called “one of the most complicated pieces of legislation I’ve ever seen.”

Democrats view Kennedy’s hesitation as a small but glaring crack in an otherwise united GOP push to fast-track market structure legislation through committee.

At 11:30 a.m., Senator Kirsten Gillibrand (D-NY) will convene a roundtable of Senate Democrats, including her New York counterpart, Minority Leader Chuck Schumer, and ten others active in the market structure talks. That group includes Sens. Mark Warner (D-VA), John Hickenlooper (D-CO), Cory Booker (D-NJ), Andy Kim (D-NJ), Ben Ray Luján (D-NM), Raphael Warnock (D-GA), Ruben Gallego (D-AZ), Angela Alsobrooks (D-MD), Catherine Cortez Masto (D-NV), and Lisa Blunt Rochester (D-DE).

In the room with members will be around ten industry C-suites, including Coinbase CEO Brian Armstrong, Galaxy Digital CEO Mike Novogratz, Kraken CEO Dave Ripley, Chainlink CEO Sergey Nazarov, and Uniswap CEO Hayden Adams, along with Circle Chief Strategy Officer Dante Disparte, Ripple Chief Legal Officer Stuart Alderoty, Jito Chief Legal Officer Rebecca Rettig, a16z crypto General Counsel Miles Jennings, Solana Policy Institute President Kristin Smith and Paradigm’s VP of Regulatory Affairs Justin Slaughter.

The goal of the roundtable is to mend fences and restart dialogue among members who angered much of the industry two weeks ago, when a leaked proposal from Democratic staffers to their Republican counterparts on regulating decentralized finance revealed just how far apart the two sides remain on what is arguably the trickiest part of an already intricate bill. Negotiations subsequently broke down, with Republicans refusing to continue discussions unless Democrats agreed to set a markup date, and Democrats insisting they needed more time to provide input and make the bill a bipartisan product.

Aides on both sides of the aisle told Crypto in America they hope the roundtables will spur a reset of talks and foster a new spirit of dialogue with the industry on DeFi.

At 2:00 p.m., some of those same industry leaders — Armstrong, Nazarov, Smith, Alderoty, Jennings, Adams, and Ripley — will join a Republican-led roundtable hosted by Banking Committee Chair Tim Scott (R-SC) and Cynthia Lummis (R-WY).

It’s unclear what the format of either roundtable will be, or whether members will come and go or stay for the full discussion. New participants at the Republican session who weren’t present at the Democratic one include Galaxy Digital’s Head of U.S. Policy Natalia Berdibekov-Li, ChainLink’s Head of Public Policy Adam Minehardt, Circle President Heath Tarbert, and MoonPay President Keith Grossman.

The Fed’s New Payments Era

On this week’s episode of Crypto in America, we’re coming to you live from the Federal Reserve’s first-ever Payments Innovation Conference, sitting down with the mastermind behind the event, Governor Christopher Waller.

The team gets the inside scoop on the Fed’s new “skinny” master accounts, a lighter version of a Fed master account designed to give legally eligible firms access to the central bank’s payments rails while keeping risk under control. Waller breaks down how it works, who can qualify, and why he sees it as a big step for innovation in the U.S. financial system.

We also dive into Waller’s take on Bitcoin, which he calls “electronic gold,” explaining why he sees it as a store of value rather than an investment vehicle. Beyond crypto, we discuss his recent interview with Treasury Secretary Scott Bessent to succeed Chair Jerome Powell and explore the Fed’s thinking on stablecoins, zero-knowledge proofs, and the broader future of payments technology.

Watch the full episode on all platforms here.

Remember, new editions of the Crypto In America newsletter drop every Monday, Wednesday and Friday at 7AM EST.

If you like what you’re reading, don’t forget to subscribe!

They need to start protecting us from the crooked exchanges that allow you make big profits on paper then you want to withdraw money your told you need to pay big money to get verified or illegally pay Income tax to them. How about that folks?

Fantastic overview! It’s fascinating to see crypto moving so fast through the legislative proccess. Senator Kennedy's comment on it being 'one of the most complicated pieces of legislation' really caught my eye. What makes these market structure bills so incredibly complex from a technical standpoint?