Crypto ETFs Beat the Shutdown: How Bitwise and Canary Took First Mover Advantage

A legal quirk allowed some crypto ETFs to launch even with the SEC partially closed

Welcome to the Wednesday edition of the Crypto In America newsletter!

What you’ll read: How the next wave of crypto ETFs came to market during a government shutdown, Nasdaq’s EVP of U.S. Markets joins the podcast, and the week’s top stories so far.

It’s shaping up to be the biggest week for crypto ETFs since Ethereum’s debut in July 2024 — and almost no one saw it coming.

Crypto’s three newest ETFs hit Wall Street Tuesday with a bang: Bitwise’s $BSOL Solana ETF led the pack with $56 million in trading volume on NYSE Arca, the biggest ETF launch of the year, while Canary Capital’s Hedera and Litecoin ETFs saw $8 million and $1 million in their Nasdaq debuts.

Later this morning, Grayscale will uplist its Grayscale Solana Trust ($GSOL) to NYSE Arca to begin trading as an ETF.

So why the surprise launches during a government shutdown? It turns out, the operation of law doesn’t always require an open government.

Earlier this month, issuers added special “no delay” language to their amended S‑1 registration forms, allowing the filings to automatically become effective 20 days after submission if an exchange signs off. This default legal mechanism, established under the Securities Act of 1933, requires no SEC approval. Traditionally, SEC staff have reviewed S‑1s and manually declared them effective before trading begins.

By updating its S‑1 first, Bitwise gained a clear first-mover advantage on its Solana ETF, just as Canary did with its Litecoin and Hedera offerings. Historically, the SEC has ensured that all crypto ETFs (including the ten Bitcoin ETFs that launched in January 2024) start trading on the same day, regardless of when each issuer filed.

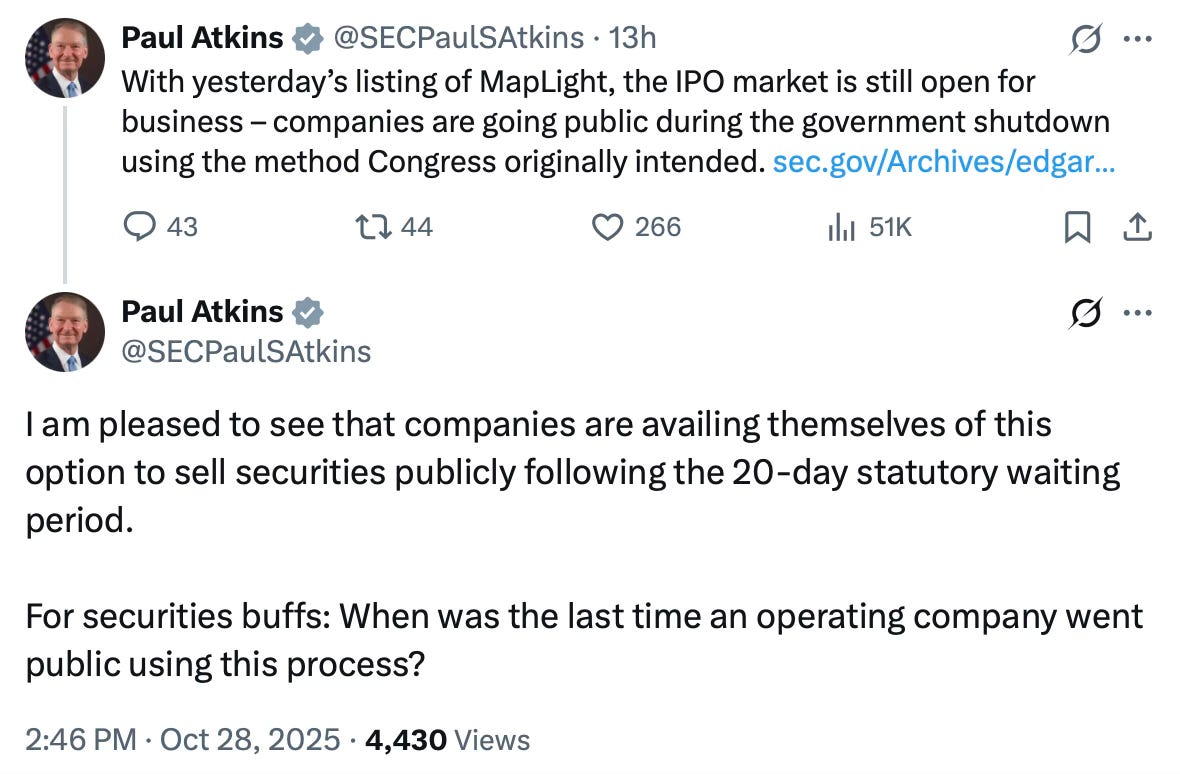

SEC Chairman Paul Atkins took to X to note he was pleased to see companies using the 20‑day statutory waiting period to go public during the shutdown, praising the same legal mechanism Bitwise and Canary Capital used to launch their ETFs.

Why it matters: A new formula is emerging for launching ETFs, with the SEC playing a smaller role than before. Expect other issuers to use this to bring products to market faster, especially while the government remains closed.

Playing Offense: Nasdaq’s Kevin Kennedy on ETFs, Tokenization, and the Future of Trading

This week on the podcast, the team sits down with Kevin Kennedy, EVP of North American Markets at Nasdaq, to unpack how the world’s largest tech exchange is making big moves in the crypto space.

From spot ETFs for Litecoin and Hedera to Nasdaq’s own Bitcoin index options and plans for eventual 24/7 trading, Kevin explains how the exchange is playing offense, not defense, in a market increasingly shaped by crypto and tokenization.

He also shares how Nasdaq is adapting to the evolving regulatory landscape while staying competitive in global markets, reflects on working alongside CEO Adena Friedman, and explains why he sees digital assets as an inflection point for the U.S. financial system.

Catch the full episode on all platforms here.

Midweek Recap

It’s only Wednesday, but it’s already been a busy week. Here are the top headlines:

Coinbase is partnering with Citi to build stablecoin payment infrastructure and expand crypto adoption among the Wall Street giant’s institutional clients.

Legacy remittance giant Western Union is launching its own stablecoin, USDPT, on Solana in partnership with Anchorage Digital, with a rollout expected early next year.

Binance founder CZ is weighing a defamation lawsuit against Senator Elizabeth Warren (D-MA) over a tweet that falsely claimed he pleaded guilty to a criminal money-laundering charge.

Sens. Warren (D-MA) and Schiff (D-CA) introduced a Senate resolution condemning President Trump’s pardon of Binance founder CZ.

Prediction market Polymarket plans to launch trading in the U.S. by the end of November, with a focus on sports betting, according to Bloomberg.

California Congressman Ro Khanna plans to introduce a bill that would ban the President and other elected officials from owning or creating cryptocurrencies, following President Trump’s pardon of Binance founder CZ.

Payments network Zelle plans to enable international money transfers using stablecoins.

Remember, new editions of the Crypto In America newsletter drop every Monday, Wednesday and Friday at 7AM EST.

If you like what you’re reading, don’t forget to subscribe!

The 20 day waiting period loophole is fasinating from a regulatory perspective. Bitwise and Canary basically weaponized the shutdown to get first mover advantage, which is exactly what the SEC normally prevents. That $8 million volume for the Hedera ETF isn't huge compared to Solana's $56 million, but it's a solid start given that Hedera's been way more enterprise focused than retail. What I'm most curious about is wether this changes the SEC's review process going forward. If issuers can just wait out the clock without active approval, that fundamentally shifts the power dynamic. The fact that Atkins praised the mechanism publicly suggests this might become the new normal, which would be good for innovation even if it means less coordnation on launch timing.