Congress Holds Line on Yield-Bearing Stablecoin Restrictions

Lawmakers unmoved by industry calls to permit earnings on stablecoin holdings

Welcome to the Wednesday edition of the Crypto In America newsletter!

On the morning of the House Financial Services Committee’s markup of the STABLE Act, the crypto industry’s calls for allowing interest on stablecoin holdings are growing louder.

Despite increasing pressure from industry leaders to approve dollar-backed cryptocurrencies that generate returns on held funds, Congressional leaders remain firm in their stance that such a provision will not be included in either the House or Senate bills aimed at creating a regulatory framework for stablecoins.

As key figures like Coinbase CEO Brian Armstrong have pointed out, traditional bank savings accounts, while offering minimal interest, still allow customers to earn returns without triggering securities laws. So, why shouldn't stablecoin holdings be treated the same way?

Lawmakers contend that their legislation is focused on modernizing payment systems, not creating an investment vehicle.

“I don't view it the same way I would view a bank account,” said House Financial Services Committee Chairman French Hill (R-AR) in a media briefing Monday. “I hear the point of view, but I don’t think that there’s consensus among the parties or the houses on having a dollar-backed payment stablecoin pay interest to the holder of that stablecoin.”

Industry leaders argue that lawmakers are simply protecting the status quo—traditional banks and large stablecoin issuers—who reap the benefits of collecting interest on reserves, while consumers pay to hold their own money without seeing any returns.

“Without yield, this isn’t financial innovation—it’s just banking as usual, but with a blockchain wrapper,” said crypto lawyer Carlo D’Angelo. “We need policy that encourages fair competition—not one that preserves the old guard at the expense of innovation and financial inclusion.”

The House Financial Services Committee will hold a markup on the STABLE Act today at 10:00AM EST. You can watch it here.

Circle's Chief Strategy Officer Warns Yield Could Trigger Securities Laws

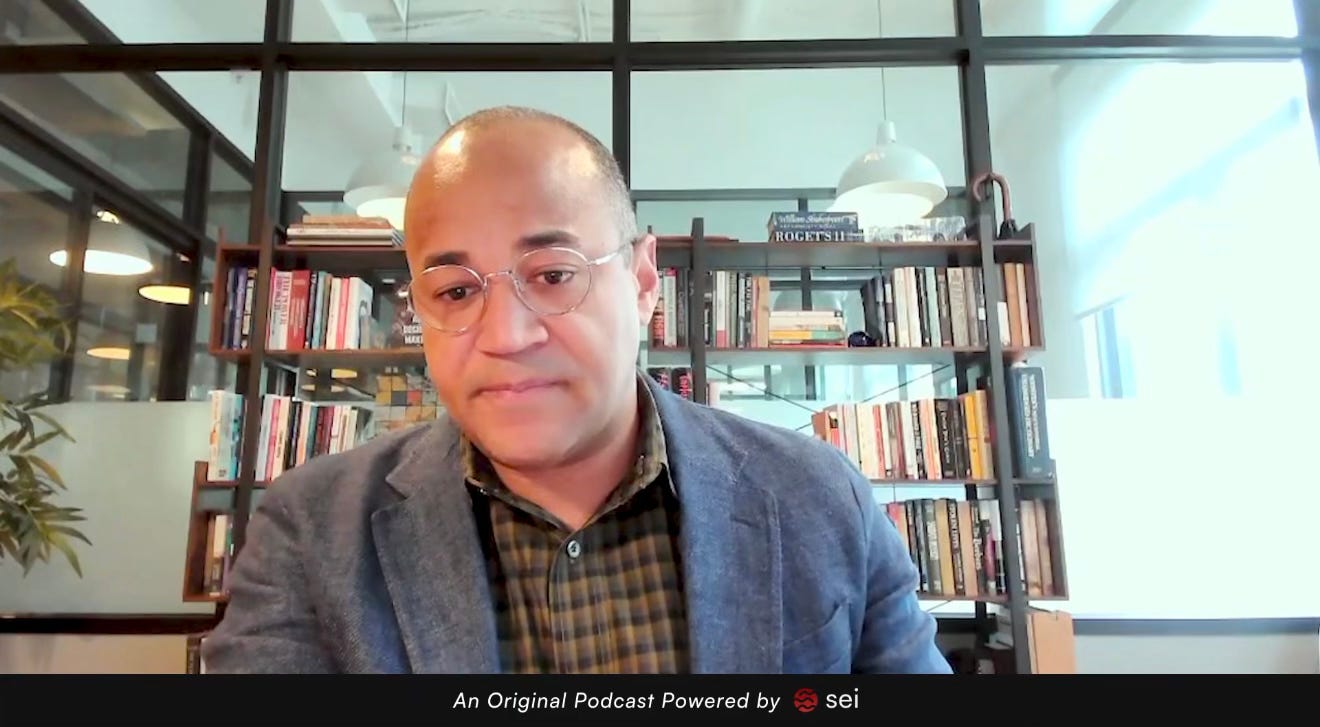

Dante Disparte, Chief Strategy Officer at U.S. stablecoin issuer Circle, tells Crypto In America why he believes lawmakers may be trying to stay away from the yield issue.

“The second you start paying yield directly from the issuer, you’re straying into securities territory or you’re straying into bank deposit territory,” Disparte said. “In our case, we’ve always wanted this to be a payments innovation with zero buyers and spenders remorse for the use of the product.”

Disparte explains that yield on stablecoins should be a secondary market innovation, where generating returns are not part of the original issuance, but occur through decentralized lending markets.

Catch the full fourth episode of Crypto In America with Dante here where we discuss the importance of stablecoin legislation, policy developments in the U.S. and abroad, building an “America-first” framework, and more.

Midweek Update

Here are some of the biggest news stories so far this week:

Circle, the issuer of stablecoin USDC, officially files with the Securities and Exchange Commission to go public on the New York Stock Exchange. The company will list under the ticker CRCL and is aiming for a market valuation of around $5 billion.

Miami-based crypto mining company Hut8 is teaming up with President Trump’s sons, Eric and Don Jr., to launch American Bitcoin Corp., a new Bitcoin mining company. The company has announced its intentions to file for an IPO.

The Senate Banking Committee has scheduled a vote for Thursday to advance the nomination of Paul Atkins, President Trump's pick for SEC Chair. The committee will also vote on the nominations of Jonathan Gould for Comptroller of the Currency, Luke Pettit for Assistant Secretary of the Treasury, and Marcus Molinaro for Federal Transit Administrator.

BlackRock CEO Larry Fink, once a crypto skeptic, doubles down on his belief in tokenization in his annual shareholder letter, saying that “every stock, every bond, every fund — every asset — can be tokenized.”

Kristin Smith, CEO of the Blockchain Association, one of Washington D.C.'s leading crypto trade organizations, has announced her departure to take on the role of president at the Solana Policy Institute, a newly established advocacy group dedicated to supporting the Solana ecosystem. Blockchain Association says it’s working on finding a replacement for Smith.

Remember, new editions of the Crypto In America newsletter drop every Monday, Wednesday and Friday at 7AM EST.

If you like what you’re reading, don’t forget to subscribe!

Congress not allowing yields on stable coins shows me they don’t want us to accumulate possible wealth. Am I right or wrong.