Circle Reverses Anti-Gun USDC Policy, Wins Praise from Senators and Gun Lobby

The policy reversal comes after backlash from conservative groups

Welcome to the Wednesday edition of the Crypto In America newsletter!

What you’ll read: U.S. senators applaud Circle for reversing its anti-gun policy and Ripple CEO Brad Garlinghouse joins the podcast to discuss the company’s future post-SEC lawsuit.

Circle, the U.S.’s largest stablecoin issuer, updated its terms of service to allow lawful firearm purchases with USDC, reversing a policy that had banned such transactions until this month.

The shift follows backlash from conservative and gun rights groups, including Americans for Tax Reform (ATR) and the National Shooting Sports Foundation (NSSF), who flagged language buried in Circle’s terms prohibiting the use of USDC for “weapons of any kind, including but not limited to firearms, ammunition, knives, explosives, or related accessories.”

Republican senators are now hailing the reversal as a victory against ‘chokepoint-style’ financial discrimination, referring to the ideological targeting of lawful businesses and consumers through financial restrictions.

“This is a reversal of Choke Point–inspired mechanisms to end run the legislative process and surreptitiously achieve liberal partisan goals,” Sen. Bill Hagerty (R-TN), author of the recently passed GENIUS Act establishing a federal framework for stablecoins, told Crypto in America. “America will no longer stand for this weaponization of our financial system.”

Wyoming Sen. Cynthia Lummis, a co‑sponsor of the GENIUS Act, also weighed in:

“Circle’s decision to allow legal purchases of firearms using its stablecoin takes a powerful stand against the discrimination targeting lawful gun owners. By aligning its terms of service with existing legal requirements rather than imposing additional restrictions, Circle is defending our constitutional rights and ensuring our financial systems cannot be weaponized against law-abiding gun owners and legal industries.”

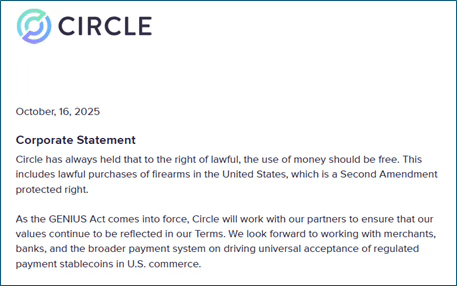

Circle had no further comment beyond the statement it provided to the NSSF last week:

“Circle has clarified our terms to reflect that USDC may be used for the lawful purchase and sale of firearms, as protected under the Second Amendment. We have not, and will not, deny the use of USDC for legally permissible transactions involving firearms.”

The backstory: On October 14, Americans for Tax Reform published an article titled “You can’t buy a gun with Dem donor’s stablecoin,” arguing that Circle’s anti-gun policy highlights the broader risk of private financial intermediaries controlling which lawful transactions are allowed.

The article drew parallels to central bank digital currencies, which critics say could enable governments to monitor and control consumer spending. ATR also suggested the policy may reflect political bias, noting that Circle CEO Jeremy Allaire’s campaign donations have largely gone to Democrats, including Rep. Jake Auchincloss (D-MA), who previously sponsored gun-related legislation.

It’s unclear how long guns have been prohibited for USDC transactions. The stablecoin has been in circulation for just over seven years, and this appears to be the first time anyone has discovered the clause or publicly raised concerns about it.

The NSSF, the leading trade association representing U.S. gun manufacturers, distributors, and retailers, weighed in days later with a tweet warning that Circle’s apparent political bias threatens Second Amendment rights.

In response, Circle said it would work with its partners to update its terms, earning praise from the NSSF, which noted the parallel to crypto’s own history of financial bias.

“NSSF appreciates the quick turnaround from Circle to state publicly and unequivocally that the company does not discriminate against lawful firearm commerce. And it’s especially welcomed news coming from a member of an industry — cryptocurrency — that experienced the same discrimination that the firearm industry has also experienced for decades.”

The bigger picture: Since the passage of the GENIUS Act, private stablecoins are becoming a larger part of the U.S. financial system, with the total market cap swelling to over $300 billion and some of Wall Street’s biggest firms clamoring to launch their own tokens.

What happened with Circle may put conservative, pro-gun, and other historically discriminated-against industries, like cannabis and gambling, on alert for similar restrictions in stablecoin policies as these digital assets become more mainstream.

It may also serve as a reminder to consumers to “read the fine print” before diving in.

Brad Garlinghouse on Ripple’s Next Chapter

This week on the podcast: We sat down at Ripple’s Swell Conference in New York City with CEO Brad Garlinghouse to unpack a year of seismic change for the company.

From putting the five-year, multi‑million‑dollar SEC lawsuit to rest and launching new products like the stablecoin $RLUSD and brokerage platform Ripple Prime, to completing several acquisitions and applying for a national bank charter, Brad walks us through how regulatory clarity is reshaping Ripple’s strategy and the broader U.S. crypto landscape.

We dive into Ripple’s long-term plans, lessons from past boom‑and‑bust cycles, the company’s approach to institutional adoption, the evolving role of XRP, and what it will take for the U.S. to reclaim crypto leadership. Plus, Brad shares his take on transparency, disclosure, and what Ripple hopes to see from the market structure bill currently being hammered out on Capitol Hill.

Watch this episode on all platforms here.

Remember, new editions of the Crypto In America newsletter drop every Monday, Wednesday and Friday at 7AM EST.

If you like what you’re reading, don’t forget to subscribe!

This reversal shows how much political presure can reshape stablecoin policies. The GENIUS Act really did force Circle's hand on adapting their terms to align with existing legal frameworks. It's a reminder that stablecoins can't operate in a vacuum when they're becoming such a major part of financial infrastructure.