Bitcoin in the Capitol: Lawmakers, Industry Rally for Strategic Reserve

Congress and crypto executives meet to advance the BITCOIN Act

Prominent figures in the Bitcoin community converged on Capitol Hill Tuesday morning to rally support for a proposed strategic Bitcoin reserve and legislation that would require the U.S. government to acquire one million bitcoin over five years.

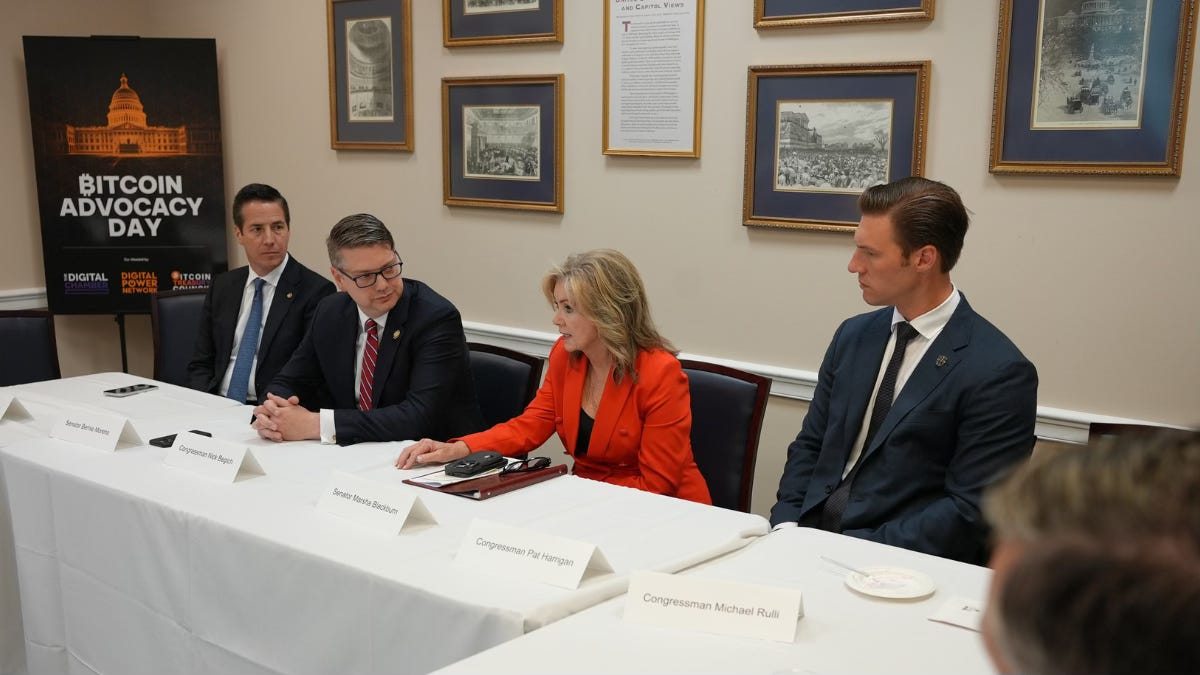

The event, hosted by the Digital Power Network and the Digital Chamber, brought together GOP lawmakers including Sen. Ted Cruz (R-TX), Sen. Marsha Blackburn (R-TN), Sen. Bernie Moreno (R-OH), Rep. Nick Begich (R-AK), Rep. Pat Harrigan (R-NC), and Rep. Michael Rulli (R-OH) alongside Bitcoin bigwigs such as Michael Saylor, Tom Lee, Fred Thiel, and executives from the major mining firms.

Also in the room: members of the newly formed Treasury Council, a coalition of corporate execs pushing crypto’s role in treasury strategy.

Some attendees told Crypto In America the meeting was productive, with most of the conversation focused on different ways the U.S. could acquire Bitcoin, including options that would not add to the federal budget.

“There is strong agreement that the we need a Strategic Bitcoin Reserve law to ensure its longevity for America's financial future,” said Hailey Miller, Director of Government Relations and Public Policy at the Digital Power Network. “There is strong alignment on the bill's importance and the right next step is to codify the SBR within the broader policy frameworks already advancing.“

The bill is the BITCOIN Act, reintroduced by Sen. Cynthia Lummis (R-WY) in March, which would make bitcoin a national reserve asset on par with gold. Earlier this year, President Trump established a Bitcoin strategic reserve barring the government from selling any bitcoin seized in criminal or civil cases. Lummis’s bill goes further — not just keeping seized coins, but actively buying more.

Outside the crypto world, the idea is controversial, with Lummis herself admitting earlier this year that it could take a long time for her colleagues in Congress to get on board.

In the meantime, Bitcoin advocates are pushing hard to keep the idea alive.

"There is a lot that's been done in the digital asset space these last couple of months, and there are a whole lot more items on the agenda for this fall," Miller said in an interview with The Block. "So our real push is to ensure that the BITCOIN Act and a strategic bitcoin reserve remain a priority.”

Speaking of Bitcoin…

A conference focused entirely on Bitcoin treasury companies takes place in New York City today, hosted by Tim Kotzman of the MSTR True North podcast.

Called Bitcoin Treasuries Unconference, the event features speakers including Strategy CEO Michael Saylor, ProCap BTC CIO Jeff Park, Strive CEO Matt Cole, Swan Bitcoin CIO Ben Werkman, and others.

Robinhood CLO on Meme Stocks, Crypto, and the Next Big Thing

This week on Crypto In America, we sit down with Dan Gallagher, Chief Legal Officer at Robinhood, to talk about his journey from SEC Commissioner to the popular retail trading platform, which recently joined the S&P 500.

We cover everything from the meme stock frenzy and how Robinhood navigated it, to crypto’s role in the company’s growth, the future of tokenization and DeFi, and why clear regulatory frameworks matter. Dan also talks about his longtime friendship with SEC Chair Paul Atkins, his take on market structure legislation, and what he’s watching next, including “the next big thing” — event contracts.

Watch this episode on all platforms here.

A Busy Day In D.C.

As Republican and Democratic senators continue talks on market structure legislation, leaders from several major crypto firms are set to meet this morning with Senate Banking Committee leadership, including Chairman Tim Scott (R-SC) and Sen. Cynthia Lummis (R-WY), according to two attendees who received invites.

The meeting comes more than a week after the committee released its latest market structure draft, outlining its updated approach to reform and incorporating industry feedback on distinguishing securities from commodities, DeFi treatment, and other key issues.

Meanwhile, all eyes are on the Federal Reserve this afternoon as markets anticipate the central bank’s first interest rate cut of the year amid signs of a weakening labor market and persistent inflation.

The news comes amid major personnel turmoil at the Fed. On Monday, the Senate confirmed Stephen Miran to serve out the remainder of former Fed governor Adriana Kugler’s term following her resignation last month. Lisa Cook also cast a vote despite President Trump’s attempts to remove her over alleged mortgage fraud. Trump has made rumblings throughout the year about wanting to remove Powell, though he has not acted on those threats.

Remember, new editions of the Crypto In America newsletter drop every Monday, Wednesday and Friday at 7AM EST.

If you like what you’re reading, don’t forget to subscribe!